File State Tax Extensions

Federal & State Tax Extensions

File State & Federal Extensions Together and Save Time

For Individuals, Families, and All Business Types in All 50 States

Start Your Tax Return

Federal & State Tax Extensions

For Individuals, Families, and All Business Types in All 50 States

Start Your Tax Return

Choose your state from the list below to access detailed instructions for both business and personal tax extensions.

Alabama

Alabama Alaska

Alaska Arizona

Arizona Arkansas

Arkansas California

California Colorado

Colorado Connecticut

Connecticut Delaware

Delaware District of Columbia

District of Columbia Florida

Florida Georgia

Georgia Hawaii

Hawaii Idaho

Idaho Illinois

Illinois Indiana

Indiana Iowa

Iowa Kansas

Kansas Kentucky

Kentucky Louisiana

Louisiana Maine

Maine Maryland

Maryland Massachusetts

Massachusetts Michigan

Michigan Minnesota

Minnesota Mississippi

Mississippi Missouri

Missouri Montana

Montana Nebraska

Nebraska Nevada

Nevada New Hampshire

New Hampshire New Jersey

New Jersey New Mexico

New Mexico New York

New York North Carolina

North Carolina North Dakota

North Dakota Ohio

Ohio Oklahoma

Oklahoma Oregon

Oregon Pennsylvania

Pennsylvania Puerto Rico

Puerto Rico Rhode Island

Rhode Island South Carolina

South Carolina South Dakota

South Dakota Tennessee

Tennessee Texas

Texas Utah

Utah Virginia

Virginia Washington

Washington West Virginia

West Virginia Wisconsin

Wisconsin Wyoming

Wyoming Alabama

Alabama Alaska

Alaska Arizona

Arizona Arkansas

Arkansas California

California Colorado

Colorado Connecticut

Connecticut Delaware

Delaware District of Columbia

District of Columbia Florida

Florida Georgia

Georgia Hawaii

Hawaii Idaho

Idaho Illinois

Illinois Indiana

Indiana Iowa

Iowa Kansas

Kansas Kentucky

Kentucky Louisiana

Louisiana Maine

Maine Maryland

Maryland Massachusetts

Massachusetts Michigan

Michigan Minnesota

Minnesota Mississippi

Mississippi Missouri

Missouri Montana

Montana Nebraska

Nebraska Nevada

Nevada New Hampshire

New Hampshire New Jersey

New Jersey New Mexico

New Mexico New York

New York North Carolina

North Carolina North Dakota

North Dakota Ohio

Ohio Oklahoma

Oklahoma Oregon

Oregon Pennsylvania

Pennsylvania Puerto Rico

Puerto Rico Rhode Island

Rhode Island South Carolina

South Carolina South Dakota

South Dakota Tennessee

Tennessee Texas

Texas Utah

Utah Vermont

Vermont Virginia

Virginia Washington

Washington West Virginia

West Virginia Wisconsin

Wisconsin Wyoming

WyomingNo, filing a tax extension does not increase your chances of an IRS audit. The IRS grants extensions automatically and does not consider them a red flag. However, accuracy in your tax return remains essential to avoid audit triggers.

The best time to request a tax extension is before the original filing deadline—April 15 for most individual taxpayers. Filing early ensures you avoid last-minute issues and penalties. The IRS generally grants an automatic six-month extension if requested on time.

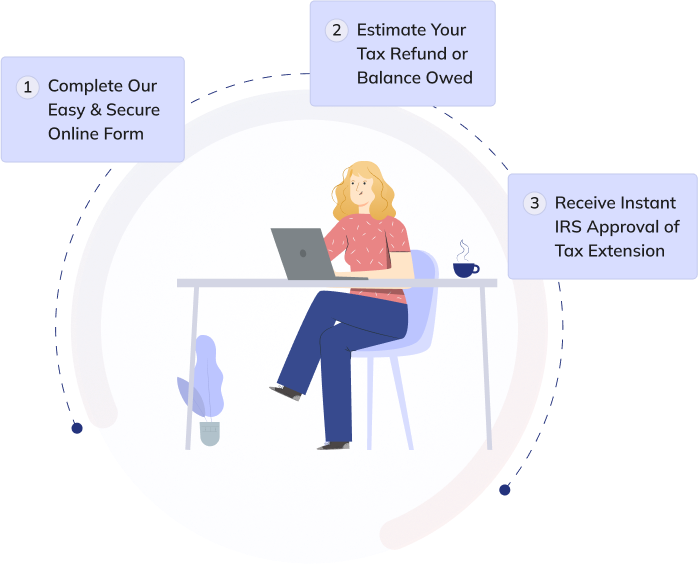

To file a tax extension quickly and securely, follow these steps:

Complete IRS Form 4868 (for individuals) or Form 7004 (for businesses).

E-file through FileLater.com for the fastest processing and immediate approval, or mail a paper form to the IRS.

Pay any estimated taxes due by the original deadline to avoid interest and penalties.

With e-filing, you receive instant confirmation, ensuring your extension is processed without delay.

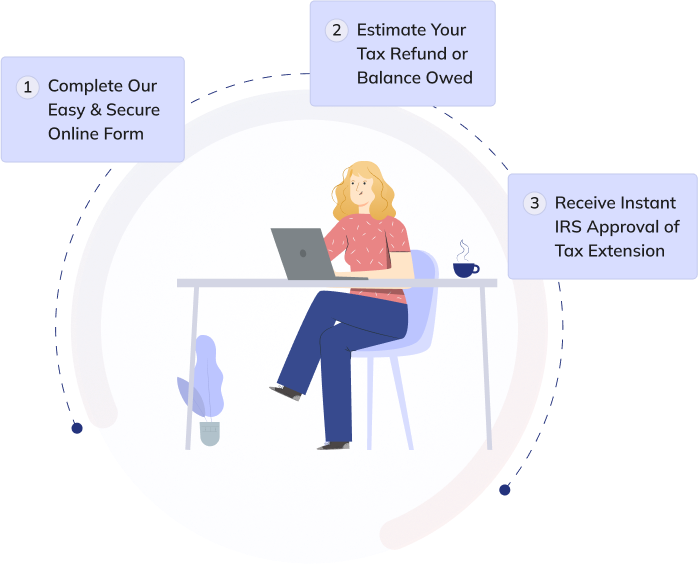

To file a tax extension quickly and securely, follow these steps:

Complete IRS Form 4868 (for individuals) or Form 7004 (for businesses).

E-file through FileLater.com for the fastest processing and immediate approval, or mail a paper form to the IRS.

Pay any estimated taxes due by the original deadline to avoid interest and penalties.

E-filing is the fastest and most reliable way to get an extension, with instant confirmation of approval.

Yes, if you owe taxes, you should make an estimated payment when filing for an extension to avoid interest and penalties. A tax extension gives you more time to file, but not more time to pay. FileLater.com allows you to e-file your extension and make a payment to the IRS in one easy step.

To complete IRS Form 4868 for a personal tax extension:

Provide your basic information, including name, address, and Social Security Number.

Estimate your total tax liability for the year and subtract any payments already made.

Enter the amount you’re paying with the extension (if any) to reduce potential penalties and interest.

E-file through FileLater.com for immediate approval, or mail a paper form to the IRS.

E-filing is the fastest and most secure way to get your extension approved instantly.

To complete IRS Form 7004 for a business tax extension:

Enter your business information, including name, address, and Employer Identification Number (EIN)

Select the tax form your business files, such as Form 1120 for corporations or Form 1065 for partnerships.

Estimate your total tax liability and subtract any payments already made.

Indicate the amount you’re paying with the extension (if any) to minimize penalties and interest.

E-file through FileLater.com for the fastest processing and immediate approval, or mail a paper form to the IRS.

E-filing ensures secure, instant confirmation of your extension request.

The deadline to file a personal tax extension is April 15 for most taxpayers. If approved, the extension grants an additional six months to file, moving the final deadline to October 15. E-filing through FileLater.com ensures fast processing and immediate confirmation.

The key rules for personal tax extensions are:

Deadline:You must file Form 4868 by April 15 to receive an automatic six-month extension until October 15.

Payment Requirement: An extension only extends the time to file, not to pay. You should pay any estimated taxes by April 15 to avoid penalties and interest.

Automatic Approval: The IRS automatically grants extensions if Form 4868 is filed on time.

E-filing through FileLater.com is the fastest and easiest way to get instant confirmation of your extension.

Yes, LLCs can file tax extensions using IRS Form 7004 or Form 4868, depending on how the LLC is taxed:

Single-member LLCs (taxed as sole proprietorships) file Form 4868, with the same deadlines as individual taxes (April 15 for filing, October 15 extension)

Multi-member LLCs or LLCs taxed as corporations file Form 7004, with deadlines based on their tax classification (March 15 for partnerships and S corporations, April 15 for C corporations).

E-filing through FileLater.com provides the fastest processing and instant confirmation.

Yes, S-Corporations (S-Corps) can file a tax extension using IRS Form 7004. The key details include:

1.) Deadline: S-Corps must file Form 7004 by March 15 to receive a six-month extension until September 15.

2.) No Tax Payment Required: S-Corps are generally pass-through entities, so the business itself usually does not owe taxes, but any taxes due should still be paid by the deadline.

3.) E-filing through FileLater.com ensures fast processing and immediate confirmation.

If you miss the tax payment deadline, the IRS may apply:

Failure-to-Pay Penalty – 0.5% per month on unpaid taxes, up to 25% of the total owed.

Failure-to-File Penalty – 5% per month on unpaid taxes, up to 25%, if you don’t file on time.

Interest Charges – Interest accrues daily on unpaid taxes, based on the federal short-term rate plus 3%.

Filing a tax extension through FileLater.com helps you avoid the failure-to-file penalty, but you should still pay estimated taxes by the deadline to minimize charges.

Navigating the intricacies of tax filing can often feel overwhelming, especially when deciphering how medical expenses impact your taxable income. With the latest IRS updates for 2025, understanding medical expense …

Read more