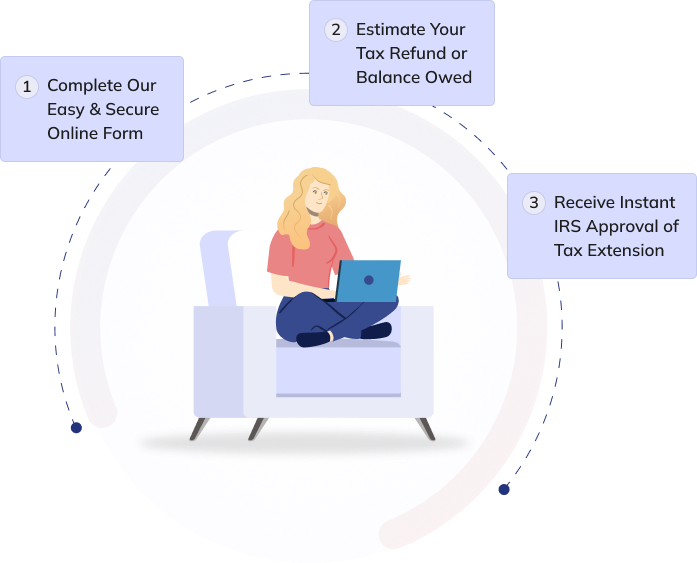

That's All It Takes

In most cases, you’ll receive IRS approval within minutes. If your extension is rejected, we’ll tell you why and help you resubmit for free. Most rejections happen due to small errors, like a name or Social Security Number mismatch, so as long as your information is accurate, approval is nearly guaranteed. The IRS calls it an “Automatic Extension” for a reason!

IRS is No Longer Accepting Extensions